31+ Take Home Pay Calculator Illinois

Well do the math for youall you need to do is. It can also be used to help fill.

Illinois Salary Paycheck Calculator Gusto

Illinois Salary Calculator for 2023 The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates.

. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Annuity payout after taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Illinois calculates state taxes based on a percentage of Federal Taxable Income. Please keep in mind that these calculators are designed to provide general guidance and estimations. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois.

However they are not final and should be viewed as a general guide for expected pay. The Illinois Paycheck Calculator is designed to help you understand your financial situation and determine what you owe in taxes. The Illinois Paycheck Calculator uses Illinois tax tables.

How to calculate annual income. Salary Paycheck Calculator Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Simply enter their federal and state W-4 information. If you make 55000 a year living in the region of Illinois USA you will be taxed 11798.

For example if an employee earns. Is the Illinois paycheck calculator accurate. Your average tax rate.

They are not official advice. Unfortunately youll have to pay taxes. That means that your net pay will be 43202 per year or 3600 per month.

Illinois Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Illinois applies 495 against your State Taxable income of 13777500 Federal Tax Calculation for. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Supports hourly salary income and multiple pay frequencies. For a Florida resident filing. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself at home. Once done the result will be your estimated take-home pay. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

504 N Stanton Street Davis Il 61019 Mls 11624683 Ilmlsni R

Illinois Paycheck Calculator 2022 2023

Illinois Paycheck Calculator Smartasset

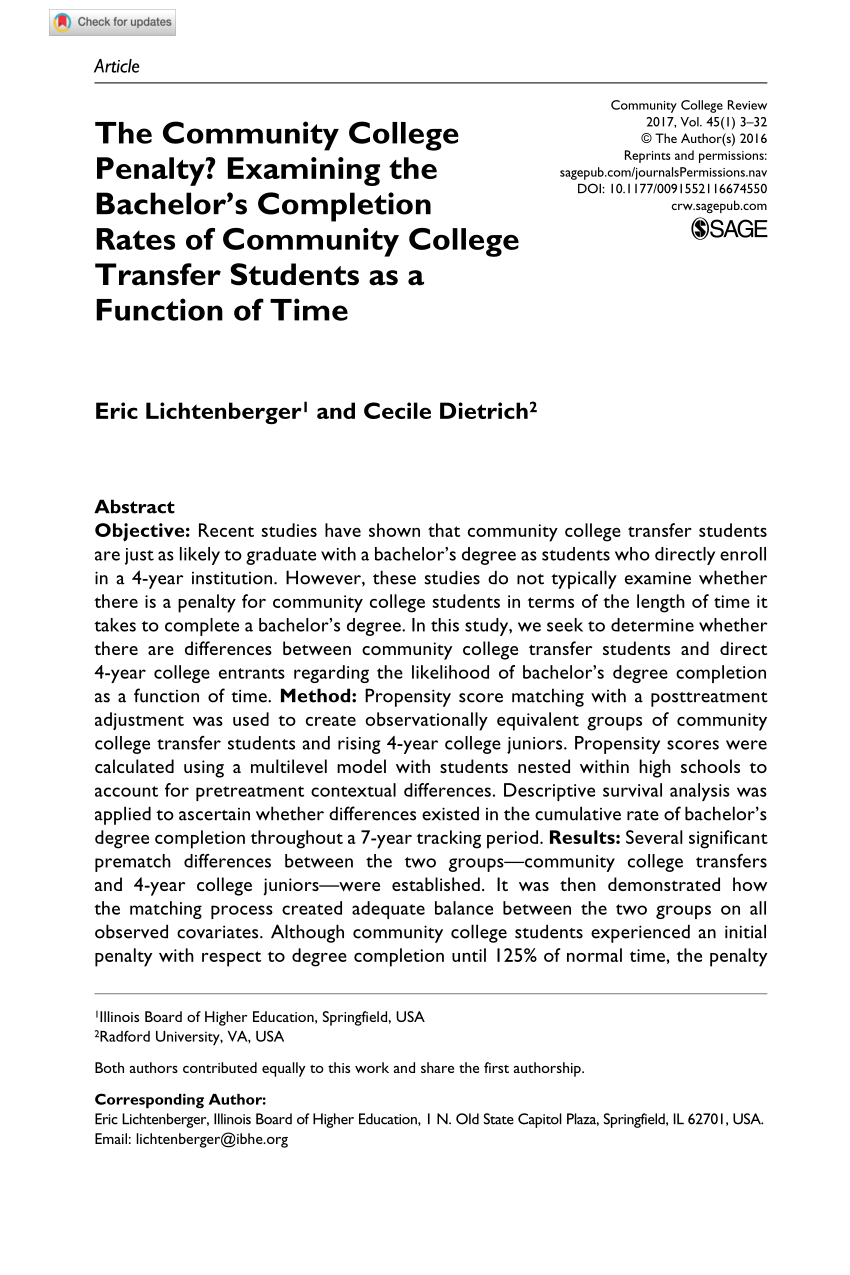

Pdf The Community College Penalty Examining The Bachelors Completion Rates Of Community College Transfer Students As A Function Of Time

Qgis Plugins Planet

Free 10 Retirement Income Checklist Samples In Pdf Doc

Journal Of Scholastic Inquiry Education Fall 2019 By Center For Scholastic Inquiry Issuu

Prepare And E File Your 2022 Illinois And Irs Tax Return

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Wairarapa Midweek Wed 16th Nov By Wairarapa Times Age Issuu

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Spss Manual Wh Freeman

Medical Coding Salary Medical Billing And Coding Salary Aapc

Free 10 Retirement Income Checklist Samples In Pdf Doc

521 Ashworth Ln Yorkville Il 60560 Mls 11355292 Redfin

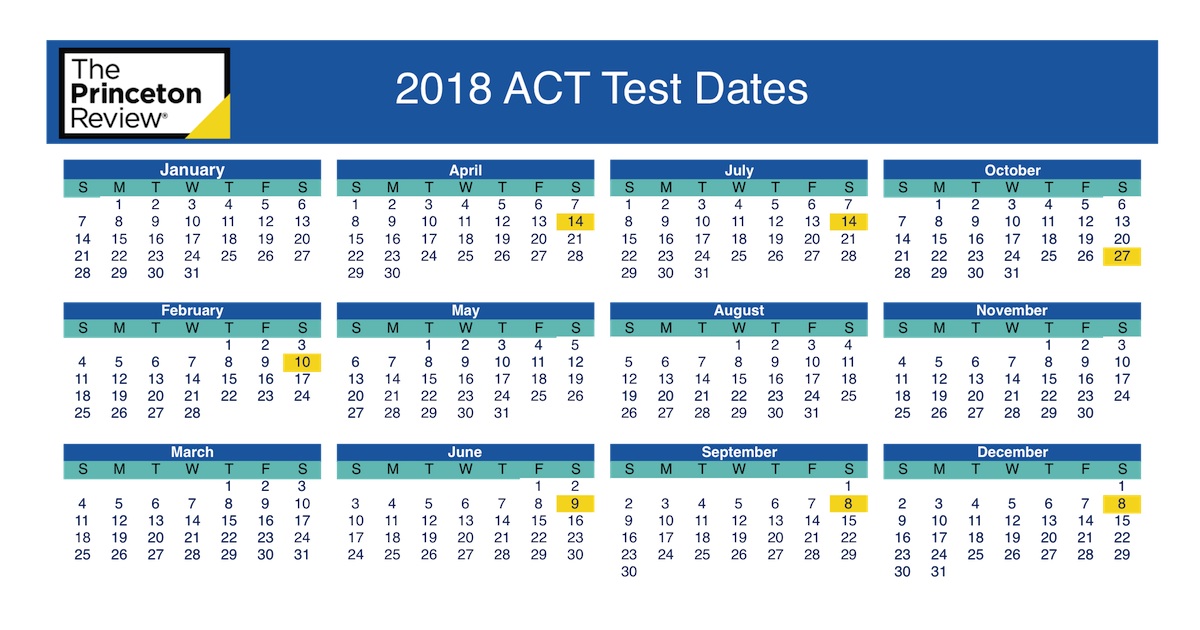

Act Test Dates The Princeton Review Allow3rdpartycookies True

Illinois Paycheck Calculator Tax Year 2022